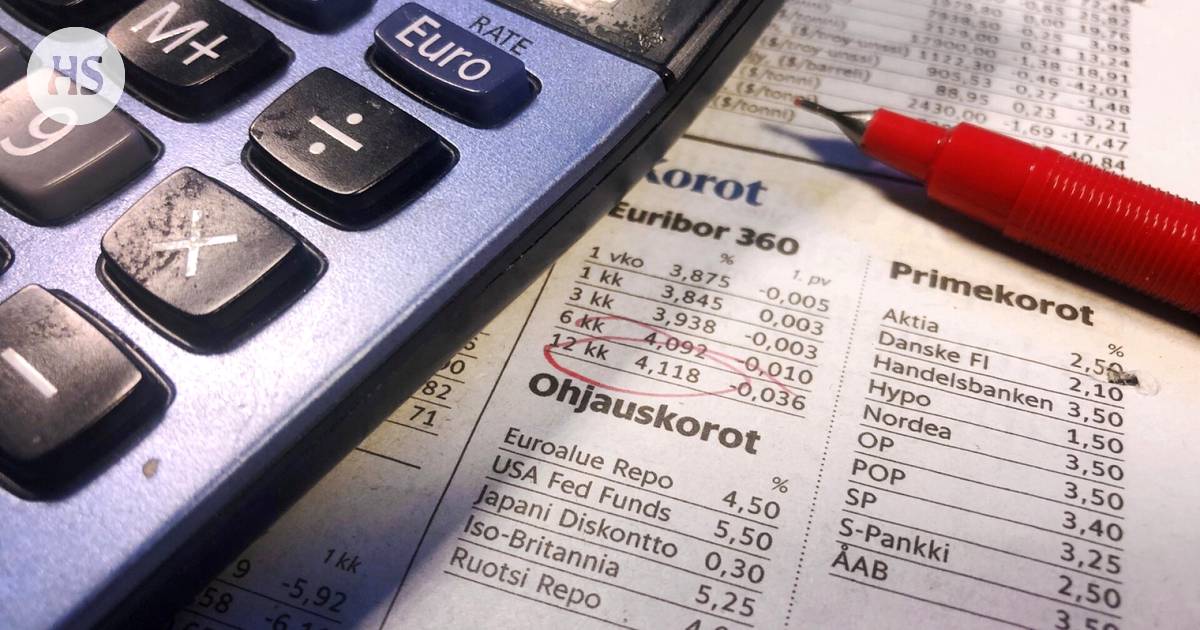

Recently, the most common reference interest rate for housing loans in Finland has shifted upwards to 3.589 percent, slightly higher than the previous rate of 3.567 percent. This rate has been slowly decreasing from peak levels noted at the end of last year, reaching over 4.2 percent just last fall after a more than four percent increase during the summer.

Shorter-term Euribor rates also experienced movement, with the six-month rate dropping nominally to 3.676 percent and the three-month rate increasing slightly to 3.714 percent on Tuesday. Changes in the Euribor reference rate often mirror movements in the European Central Bank’s key interest rates, as observed through various speeches by members of the bank’s policy-making council over the early summer.

While the ECB recently lowered its bank deposit rate by 0.25 percentage points to 3.75 percent in June, details on future interest rate changes have yet to be confirmed. Speculations on potential rate cuts arise from ECB President Christine Lagarde’s statement that inflation concerns persist, indicating no immediate plan to lower interest rates. The central bank’s objective is to maintain annual inflation around 2 percent in the medium term.

The preliminary data on harmonized inflation in the Eurozone revealed a slowdown to 2.5 percent for June from 2.6 percent in May, with Finland recording the slowest inflation rate at 0.6 percent within the region